SARs are a particularly well-suited employee participation and compensation tool for the modern organization. We will show a number of properties such plans have and how their nature and the ways they can be designed and managed make them a very compelling alternative to other vehicles, namely employee share grants or option plans.

Finally, we will address topics often considered by stakeholders that are interested in virtual share plans. These include some basic accounting considerations when deploying such compensation schemes, clarification of blockchain technologies, and practical aspects to be addressed when introducing these plans in a Benefits and Compensation program.

Introduction

For the modern HR organization, the variable compensation component is the differentiator in the salary package. Next to a classic fixed component, which typically aligns with competitive salaries, the variable and incentive-based part is linked to both personal and organizational performance, providing a motivational boost for employees. For highly skilled employees with significant contractual power, this becomes crucial ([Ali20]).

Next to a brief examination of the most common tools for variable retribution, we will focus on Share Appreciation Rights1 (SARs2) in this article, and explore the benefits in terms of adoption simplicity and technological friendliness, particularly with regard to employee share option plans (ESOPs) and certificates (e.g. STAK).

Finally, we will address some commonly discussed topics, both from the practical adoption side and from the technological enablement side.

Employee participation plans: what are they, and what do they mean for the organization?

An employee participation plan is a compensation instrument in which part of the salary package, typically its variable component, is tied to the organization’s performance. This participation may be related to the revenue generated by the enterprise or to its shareholder value.

Throughout the history of modern organizations, participation plans have served several purposes, all of which are essentially linked to the same objective: providing a financial incentive for employees to enhance their motivation and retention. On the one hand, it encourages a result-oriented mentality. When additional compensation is tied to achieved results, employees become actively involved in determining their own compensation. On the other hand, especially in a few sectors and business models, it is a traditional way to promote the best employees to the shareholder level. By becoming a shareholder, the employee might be required to trade in part of their fixed salary component in exchange for substantially higher earnings as a shareholder.

In more recent years, and especially with the latest generations entering the workforce, namely generations Y and Z, participation plans are an excellent way to cater to the preferences of the younger workforce, as they value personal ownership and tangible results ([Laan18]). Possibly as a reflection of disintermediation, a trend in many diverse areas and industries, from social media and digital advertisement to personal finance, younger workers have become accustomed to shorter feedback loops, where the rewards of their hard work are realized right away. Differently stated, younger generations might be less inclined to see their careers as marathons; they think of them as a series of shorter sprints, with clear feedback and timely gains, instead of delayed, long-term compensation.

SAR: the virtual share plan for the modern organization

In its general definition, a virtual share gives the participant of a virtual share plan the right to the value appreciation of a reference asset. Typically, such reference asset is the physical share of a so-called tracked company. Usually, virtual shares are compensated (settled, technically) in cash. Plan participants receive them for free or at a nominal price. To better understand the concept in its simplicity, an example:

- a plan participant, called Judy, receives 100 virtual shares

- a virtual share is indexed on a physical share of Judy’s employer, Acme, Inc

- at the moment of joining, February 2024, a physical share of Acme, Inc is worth 1 EUR

Fast-forward two years, and thanks to Acme, Inc.’s exceptional performance, the company is valued at 2 EUR a share: a 100% value increase for Judy’s position. When and how will Judy be paid? This is what we call a liquidity moment: in particular, for a private enterprise (like a startup or scaleup), this could be a so-called exit event, where the company is acquired, in toto or partially, by another party.

Figure 1. In a Share Appreciation Plan, the participant becomes entitled to participate in the future value appreciation of a reference company, with this entitlement being realized in connection to specific events. [Click on the image for a larger image]

When considering virtual shares as a financial instrument, it is important to view them as a flexible framework. For instance, an organization implementing a virtual share plan can choose to settle in physical shares, require payment for the virtual shares based on a valuation (usually tied to the latest known company valuation), or establish a different reference for value, such as entitlement to dividends. In exceptional cases, virtual shares may even be granted indirectly through options. This said, let’s keep in mind the simple example above, which is best suited for a small or medium private (i.e. non-public, unlisted) enterprise (the kind of enterprise which we will informally take as a model for the purpose of this article).

With our example in mind, let’s look at some properties of a virtual share plan that are particularly valuable for an agile HR organization ([Geno22]):

- No need for expensive paperwork. The value of virtual shares is derived from a reference index, but since no physical shares are transferred, the cap table remains unaffected.

- Alignment of perspectives. If the virtual share plan allows, an equity round – a pivotal moment for a startup or scaleup – can also be considered a liquidity event. This approach shifts the team’s focus towards medium-term achievements and milestones.

- All of the upside, none of the downside. When the participants get their virtual shares for free, a commonly accepted best practice, the employee knows that they incur no risk and that the virtual shares behave as a bonus; in the worst case, there will be no appreciation.

For the participant

For a participant receiving a virtual share issuance at little or no cost, the most crucial factors are the size of their participation (i.e., the number of virtual shares received) and the entrance valuation, which is the reference value of the company at the time of issuance. It is commonly accepted practice that this should be the latest known valuation. If the reference company has no known valuation, a valuation exercise should be carried out: this is an essential step in guaranteeing a transparent value for the issuance itself.

For the shareholders

Implementing a virtual shares plan represents a commitment of the shareholders to the plan participants. Even though the realization of this commitment may take place in the medium or long term in case of an exit event, when it manifests itself, there is an obligation to settle the shares by paying out the cash bonus. Therefore, within the scope of a due diligence process approaching the exit event, the nature of the virtual share plan as a liability must be considered.

The spectrum of participation plans: from classic performance bonuses to real shares

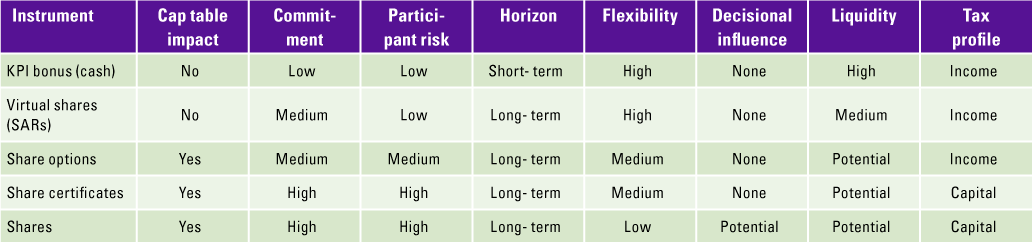

According to the desired mix of participation in terms of entitlement, a number of different instruments are available (see Figure 2).

Figure 2. The participation plans spectrum. The mutual commitment between the employee as participant and the employer as plan promoter grows from left to right. [Click on the image for a larger image]

At the very left of this spectrum, we have cash bonuses. Employees benefit from additional incentives, which vary in formality and transparency, and are linked to their individual performance, the performance of their group (department, line of business, etc.), or the overall performance of the organization. It is worth noting that such a performance does not need to be strictly financial (e.g. sales targets, revenue volumes, etc). At an individual level, key performance indicators (KPIs) for bonuses can be highly technical, such as achieving a positive HR assessment during a year-end review based on team-wide metrics.

At the very right, the strongest form of participation is shareholding. By definition, a shareholder becomes an owner of the company whose shares they hold. This is a very strong form of participation, and shareholders may enjoy the enterprise’s financial performance in direct returns (most importantly dividends) or appreciation (the market value of their shares participation). Share ownership involves several important considerations. For private (non-listed) enterprises, share ownership is relatively static. In contrast, for public enterprises, the liquidity of shares is influenced by classic factors such as market capitalization.

Somewhere in the middle, not just figuratively but as a combination of pure emoluments and shared ownership, Share/Stock Appreciation Rights (measured by virtual shares as we will often refer to them) give entitlement to the financial performance of the reference company without requiring an actual transfer of physical shares. Note: we intentionally say physical shares and not real shares to refer to the outstanding shares of the reference company; in a later section, we will briefly reflect on the difference between physical and virtual shares. In this sense, they are virtual because they do not belong in the pool of outstanding shares of the reference company; they are a separate issue.

SARs in the participation spectrum: an overview

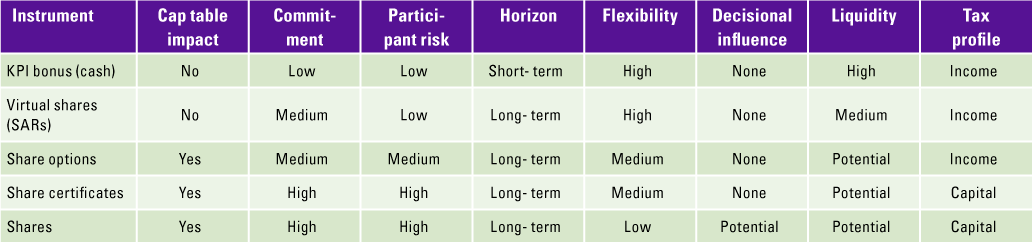

To provide more context, let’s examine the most relevant participation plans across several important and practical dimensions that matter both to the employee joining the plan and to the employer granting the participation. Within this comparison, the reader is reminded that the model organization where the plan is promoted is a private enterprise (startup – scaleup, or SME more in general). For options and the like, we look at their properties in a pre-exercise perspective. While all of these dimensions are applicable to a listed enterprise as well, not all of them might be equally relevant (e.g. cap table impact). Also, we would like to scope the discussion in order to better highlight the differences across this participations spectrum.

Table 1. A comparison of different participation plans, along with dimensions relevant to both the participant and the employer. [Click on the image for a larger image]

Let’s look at the dimensions in Table 1 in a little more detail.

Cap table impact. The capitalization table (‘cap table’) is of particular relevance for early-stage enterprises, specifically startups and scaleups. It represents who owns what, which plays a crucial role not only in financing rounds but also in the dynamics among shareholders. Similarly, a virtual share plan does not affect the cap table: share appreciation rights are measured by virtual shares and do not confer any direct or indirect entitlement to physical shares. On the other hand, possessing physical shares, either directly or indirectly via options or certificates (in the Netherlands, typically via a trust office foundation or STAK), results in a cap table impact (for options or certificates, in the potential sense of the exercise).

Commitment. Here, we refer to the commitment from the employer to the employee: the more substantial the participation plan (substantial in terms of the various dimensions we are considering, from Low to High, etc.), the stronger the formal relationship between the two parties. Here, a cash bonus is the weakest form: the compensation integration is solely based on the employee (department, organization…) performance, and no further agreements are entered. Thanks to the virtual share entitlement, participation is complete from both a financial and legal perspective, yet no actual transaction occurs. There is no entitlement to physical ownership of the company. With stock plans, when a package of physical shares is granted or exercised, the participant becomes a shareholder: the larger the position, especially in private enterprises, the larger the incumbency of the participant.

Participant risk. With risk, we refer specifically to financial risk, which is intended as the degree of exposure for the participant upon joining a plan. For cash bonuses, it is zero. For all share- and share-based emoluments, the main component is the granting price: leaving discussions around price and value aside, if participants are offered the plan membership at no upfront costs, we may argue that the downside risk is zero from a financial perspective: as noticed above, if no appreciation takes place, the participant had no buy-in costs. For option plans this is usually the case too, but the financial commitment is generally postponed until the exercise moment. In the case of shares, direct participation normally comes at a price, requiring the participant to arrange some form of financing to join the plan. Additionally, and specifically for assets like stocks and stock options, legal and tax risk play some role too: think of the liability of a shareholder with substantial interest; or, from the perspective of the single participant, the pecuniary consequences of incorrectly handling the tax profile of their options position.

Horizon. The horizon of an incentive plan is tied to the commitment dimension in time duration. Along the entire share-like lineage, the employee and the employer look at a long-term relationship, sealed by the participation plan. The feature modulating the time relationship is vesting. The definition of “long-term” can vary significantly across different industries and geographical locations. For some, the term might refer to a period of three to five years, which is often considered medium-term. In contrast, share grant compensation packages with full vesting periods extending eight to ten years, featuring different scales and progressions, are also common.

Flexibility. Here, we will look at the flexibility in legal nature, excluding any unlocking policy (e.g. KPIs) to which the participation is subordinated or other financial matters (e.g. liquidity). Flexibility is closely linked to the instrument itself and the media where the agreement is disciplined (e.g. paper vs. digital contracts): this becomes less and less as we go down the table, and it is directly proportional to the degree of digitization of the agreement (in advanced smart contract scenarios, including policy enforcement). For example, the degree of flexibility in a shareholder agreement for a typical private company is often quite limited. These agreements follow traditional legal protocols, involving paper documents drafted and certified by lawyers and notaries. They usually include various restrictions that limit the shareholder’s freedom of action, such as constraints on the sale and disposal of their shares. On the opposite end of the spectrum, a KPI bonus codified and enabled (including payments) in an entirely digital fashion may have its own codifications and operational automation, in rather advanced and arbitrary ways.

Decisional influence. With this dimension we identify how much influence a participation plan attributes to its participants, again in the legal sense: what rights does the participant acquire? A common proxy for shareholder rights at large is voting rights. Virtual shares in their common form do not come with voting rights: the rationale is enjoying the upside of the financial performance. For physical stock issuances, the share class informs voting and other rights (e.g. dividend rights), and the landscape can get pretty involved for listed companies (e.g. multiple, non-mutually convertible share classes). For private and smaller enterprises, voting rights and, in general, the involvement of all shareholders in the decision and information process during corporate rituals like general assemblies and such may not be ignored.

Liquidity. We have already hinted at this dimension. From a classic financial perspective, liquidity refers to the ease and convenience of exiting the participation plan. Here, we are interested in the ergonomics of exiting the plan, because it is where any gains might be realized (dual considerations, especially for share-based plans where joining requires some form of financing when entering the plan, can be discussed). For instance, a fully matured stock position in a listed company represents a very liquid situation. Realizing any gains simply involves disposing of the position in the relevant public market. This process is standard and easily achievable, even for large shareholder positions, assuming the underlying stock itself is sufficiently liquid. At the other end of the spectrum, realizing gains from a minority stake in a private enterprise is a considerably more complex endeavor. Such a sale is often an expensive, paper-intensive process, involving numerous formalities and a very limited pool of potential buyers. Additionally, the size of the position plays a role, as a minority stake might be less attractive to prospective buyers. In a middle field, share appreciation rights are very ergonomic in this sense; when a so-called liquidity moment (e.g. exit) takes place, participants have their due payouts transferred directly, with no action required. As a matter of fact, no formal impediments (e.g. explicit exercises or confirmation) should get in the way of the participant exit.

Tax profile. See below section “Tax considerations”.

In the following section, we will further compare share plans.

Comparing with share plans: differences in the implementation and enablement

Thanks to their wide adoption for startups and scaleups and most of the largest public enterprises, participation schemes based on physical shares are very popular. In this area, the most common flavors are:

- share grants

- share options

- share certificates

The main difference regarding/virtual shares is rooted in the underlying asset itself, that is, in the physical shares themselves. Both for the private and public enterprises, we could discuss the advantages or disadvantages, but let’s just mention a couple of advantages and disadvantages for the startup/scaleup or SME:

- Practical reasons. The overhead of a physical share plan is significantly higher than that of a virtual share plan, not only in terms of plan design and deployment but also from the accounting and legal perspective.

- Convenience reasons. Especially for young and promising startups, committing part of their equity for compensation purposes can complicate their cap table and even become a risk factor to the extent that such portion is deemed too large by the investor, or that the employees benefiting from that have left the company.

- Illiquidity and pricing considerations. While working with floating shares and options comes with an intrinsic liquidity premium for the large publicly listed enterprise, things are the exact opposite for a small private company. Here, the pricing of option instruments, already complex in its own right, can become almost prohibitive and sometimes futile due to the absence of recent and adjusted valuations.

An important point in favor of physical shares is that they allow the participant to have a more direct and deeper identification with the shareholders. While employees usually understand the benefits and upside-only scheme represented by virtual shares, participants in a physical shares plan might feel an even stronger sense of belonging.

The reader interested in comparing physical and virtual share plans “from the Silicon Valley trenches” is referred to [Kind24].

Some pointers to accounting and pricing practices for SAR

Even if they are relatively less popular than classic stock option plans, virtual share plans come with accounting standards that provide clear guidance for accurate pricing and financial reporting. In Europe, the International Financial Reporting Standard 2 (IFRS 2), also known as Share-based payment, serves as the accounting reference. On the other hand, the United States follows specific guidelines within the US Generally Accepted Accounting Principles (GAAP) framework, particularly those found in the Accounting Standards Codification (ASC).

When it comes to pricing and valuations, the valuation of a virtual share issuance is mostly based on the most recent valuation for the reference company. On the other hand, in the case of additional features (such as vesting schemes), some discounts should be applied accordingly.

Tax considerations

Discussing the tax treatment of virtual share plans falls outside the scope of our article. For the reader interested in the topic, the first point of attention is the following: the tax treatment may differ across different European Union jurisdictions. The critical consideration is the dualism between an income and capital profile (the latter comes with additional concerns around capital gains).

Given its nature as an incentive and participation plan, a company promoting a virtual share plan should be well aware of plan participants’ responsibilities in this regard, particularly regarding the tax obligations associated with the final compensation.

SAR for a digital-first and dynamic employee participation plan

In general, a virtual share plan is easy for the participant to understand. However, we argue that understanding it as a benefit is not enough: for the agile and digital-first HR organization, the SAR plan should come to life on an interactive platform, ideally a web or mobile application. In this section, we aim to outline some best practices that a solution for virtual share plans should adhere to. Many of these practices are applicable to share plans in general.

Pros & cons of SAR

Now that we have discussed SAR in general and compared it in quite some depth to other participation instruments, let’s distill the main takeaways into a few pros and cons.

Pros

Flexibility. Extending this dimension to for example commitment, impact and risks, SAR offers the employer a high degree of freedom while retaining the core financial benefits for the employee at low enablement costs. Thanks to its digital-first nature, when a participation plan is set up according to commonly accepted best practices (see next section), participants can enjoy a real financial upside without the need for complicated legal structures and limitations.

Enablement. Closely linked to the flexibility point mentioned earlier, due to its nature as an indexed bonus program without any changes to the cap table, there is no need for notarial deeds. While the current shareholders should always be involved in the decision process, and possibly the design of such plans, the enablement may be self-contained within the duties and activities of the reference head (e.g. CHRO), with limited and well-scoped external support.

Long term. While not all participation plans necessarily have a long or even medium term, the horizon for transformative and ambitious goals is well supported by a participation plan which does not put quick profits before the fruits of an exciting and rich journey. This is the ideal alignment for growth-led companies where significant growth milestones are typically achieved in the three-to-five-year horizon, and a so-called exit moment might not occur earlier than an eight-to-ten-year mark.

Cons

Tax treatment. As mentioned earlier, the tax treatment of virtual share plans may vary, and in this sense, they may turn out to be more or less interesting than other participation alternatives. When dealing with these considerations, the plan promoter must have full visibility, and details must be clearly and timely explained to the plan participants in order to avoid disappointments when the plan participation gets redeemed (liquidity moment).

Upside. The virtual part is a double-edged sword: very sharp regarding the profiting mechanism, rather blunt if a participant’s position in the plan is insignificant. Also, even when the participant has an important virtual stake, doubts or perplexities may arise when they compare their upside with that of a first-hour shareholder (e.g. founder). This is an impairment in the participant’s interpretation, which is easy to prevent thanks to a clear explanation during the onboarding process. Among other things, it must be clear that the participant has no downside risk of exposure when joining the plan. In contrast, company founders (or equivalent) most probably had to take financial risks to start the company in the first place (whether materially or in the form of opportunity costs etc.).

Understanding. While most share-related plans share some concepts and features (vesting, for example), a SAR plan’s flexibility and digital enablement might result in excessively involved rules and automation, especially when it comes to earning and losing participation units. Therefore, a clear understanding is vital when it comes to the potential upsides of the plan membership and the active lifecycle (see Best practices) of the virtual shares participation or its entitlements (absence of voting rights, no convertibility to ordinary shares, etc.).

Best practices

Make complex things easy. The plan manager cannot get lost in an intricate jungle of legal clauses, even if the matter is entirely delegated to a trusted advisor. The reason is simple: a shares plan is a living thing, and a solid understanding of it is needed for the manager to be able to present and defend it in front of other stakeholders, as well as to maximize its positive effects when presenting it to current and prospective employees.

Look at the whole lifecycle. A (virtual) equity plan grows and evolves together with the participant. And sometimes, it goes on even after the participant leaves the company or the plan. The platform should support this: whenever the position of the plan participant changes, the events triggered by such change should be visible and clear on the platform. To be complete, the virtual plan participation should take an active role already in the salary & compensation discussions between the hiring manager and the candidate.

Be transparent. Register mutations on the platform as they occur. The chief example for an exit-based virtual shares plan is an updated company valuation. It is a great feeling for the participant to see their position accrue in value, hand in hand with an increase in the company valuation. On the other hand, a decrease in valuation should also be registered in a timely manner. The platform should always be the source of truth to assess the value of the plan positions.

Integrate. To support dynamic and continued updates of the participant positions, especially if the plan clauses rely on individual or group KPIs, realize direct integrations with relevant solutions from the enterprise IT landscape, namely HCM, EPM and ERP platforms.

Allow for flexibility. According to the plan manager’s mandate, the platform needs a certain degree of flexibility. For instance, all plan participants should be aware that the platform might disclose specific information exclusively to selected plan participants.

Support different and multiple roles. Plan managers can be seen as a product persona, especially in larger enterprises, meaning not a single individual but rather a team. The platform should be very clear about the roles of the plan management team. Most importantly, inviting participants to a plan or accessing their information should come with special permissions and restrictions. On top of this, some plan managers might have a dual role: as participants, they should not be able to modify their plans arbitrarily.

Show clear disclaimers. Regarding the nature and specifications of the virtual equity plan, a signed agreement between the employer and the employee should be binding. The agreement should take precedence on any additional text, dashboards, knowledge base or virtual assistants offered by the platform for the participant’s convenience. In particular, all this information should not constitute legal or financial advice, and it should not be regarded as such.

Be privacy-aware. While the basic information of the plan participant may be retained in connection with the legal and financial requirements of the plan itself, the platform should limit itself to collecting the essential information and nothing more. For a share plan, this is information about the participation itself and sometimes additional context (like the department a participant works for).

Support the initiative’s evaluation. Evaluating the success of a participation plan can be arduous, especially when it is offered to a whole cohort of employees and when the liquidity event takes place in an undefined future. Nevertheless, a yearly frequency is a good start. The central HR systems should coordinate this activity, finding proper space for it within the known rituals (e.g. employee satisfaction surveys).

Common misunderstandings around virtual shares

In this section, we will address a couple of common misconceptions about virtual share plans.

Real shares are better than virtual shares. This argument is rooted in the dualism between real and virtual as adjectives. Practitioners typically address this by using specific terms. For example, they might refer to the indexed shares of the tracked company as “indexing” based on their function, or as “outstanding capital shares” when considering their nature. Neither term is inherently superior; they simply represent two different perspectives.

Virtual share equals blockchain. Let’s take the word blockchain as a compact alias for append and read-only distributed permissionless log (with permissionless as publicly distributed, see [Spen17]). We see that this is just a specific class of software systems, and it has nothing to do with a participation plan. A platform to support the management of a share plan just needs to be a simple database at its core, and it is permissioned too, for obvious reasons. From a theoretical perspective and allowing for some notation flexibility, adopting a permissioned blockchain is a possibility for implementing a virtual shares plan, yet the plan manager should express a clear requirement for a such a technological complication.

Virtual shares are a passive source of income. Like any other participation scheme, the answer should be no: they are an employee incentive scheme, related to their job. A well-designed incentive plan follows the participants along their journey as an employee, and therefore it should have clear provisions for when the participant stops being an employee.

Conclusion

After introducing general employee participation plans, this article focused on a specific kind: Share Appreciation Rights (SARs). It highlights their qualities as a healthy balance between a pure cash bonus and classic stock ownership while considering some practical concerns. Putting its enablement in perspective, the different properties of a software solution to manage virtual equity plans should exhibit were outlined, drawing from common best practices. Finally, common misconceptions about virtual share plans were clarified, especially regarding their technological enablement. My conclusion is that Share Appreciation Rights are a valuable alternative tool in the salary and compensation structure. They are ideal for facilitating employee participation plans with reduced overhead compared to physical stock and option plans, making them well-suited for digital-first enablement.

Acknowledgments

The author wants to thank the KPMG team for their support during the preparation of this article. In particular, Ronald Koorn for the fruitful discussions around the article structure and topics, and Aram Falticeanu for his opinion when comparing different incentive vehicles. Special acknowledgments to the team at Sharesquare, who provided a lot of knowledge for this article and shared many best practices from customers applying SARs. Sharesquare offers a specialized platform for creating and managing SAR plans.

Notes

- In spite of having two different meanings, “share” and “stock” are quite often used as synonyms, so Stock Appreciation Rights is pretty common too. We will loosely refer to stock when intending a shares package or similar.

- We will refer to share appreciation right(s) as SAR or SARs respectively, yet interchangeably.

References

[Ali20] Ali, B.A. & Govand, A. (2021, 12 March). An Empirical Study of Employees’ Motivation and its Influence [in] Job Satisfaction. International Journal of Engineering, Business and Management (IJEBM), 5(2), Mar-Apr 2021; par. Incentive. Retrieved from: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3824637.

[Geno22] Genova, R., Lievense, N., & De Vries, E. (2022). Why organizational agility starts with HR: How agile HR can reimagine the organization and work of the future. Compact, 2022(2). Retrieved from: https://www.compact.nl/articles/why-organizational-agility-starts-with-hr/

[Kind24] Kinder, T. (2024, 12 March). Tech start-ups are giving new hires fewer shares as valuations cool. Financial Times. Retrieved from: https:/www.ft.com/content/cc125457-5f2d-457e-8f6b-0bc3d686daf5

[Laan18] Van der Laan, A. & De Leeuw, S. (2018). CFO? CIO? The world needs a CHRO! The future of HR: the Chief HR Officer as strategic partner. Compact, 2018(1). Retrieved from: https://www.compact.nl/articles/cfo-cio-the-world-needs-a-chro/

[Spen17] Spenkelink, H. & Hough, G. (2017). Blockchain: From hype to realistic expectations. Compact, 2016(4). Retrieved from: https://www.compact.nl/articles/blockchain/